Chartered Accountancy (CA)

If you are looking for a business career that offers prestige, respect, great prospects and excellent financial rewards, becoming a CA is the perfect place to start.

Chartered Accountants are an extraordinary group of people. Wherever they work, they make a difference. They’re ambitious. They’re talented. They’re in demand.

Studying to become a Chartered Accountant will set you apart and being ‘chartered’ takes you way beyond traditional accountancy and business training. The CA qualification is a prestigious and internationally respected qualification that will provide you with the knowledge, skills and values you need to be highly regarded and sought-after business professional.

The CA qualification is exceptional. It’s a prestigious and internationally respected qualification that will provide you with the knowledge, skills and value to be highly regarded and sought – after business professional.

The CA qualification is comprised of professional study and relevant practical experience.

CA Syllabus

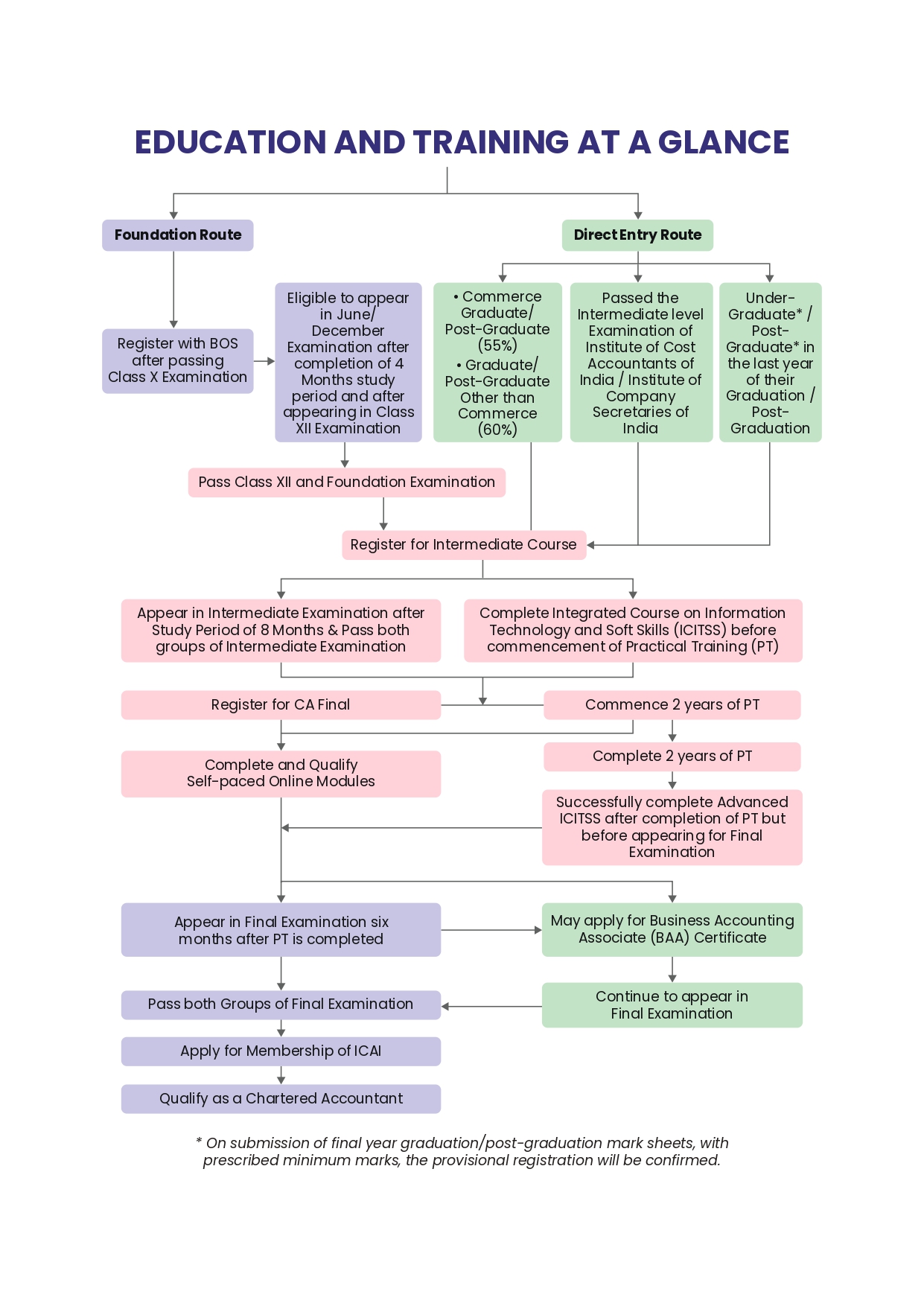

The Chartered Accountancy examinations are divided into three levels. They are

- Foundation Course

- CA Intermediate

- Final Examination

FIRST STAGE - CA FOUNDATION

(Entrance Exam)

Register with Board Of Studies (BOS) after passing Xth examination so as to complete four months study period after appearing in Xllth Examination. Appear for Foundation Examination in January/ June / September.

Paper 1 : Accounting (100 Marks)

Paper 2 : Business Laws (100 Marks)

Paper 3 : Quantitative Aptitude (100 Marks)

- Part 1 : Business Mathematics and Logical Reasoning (60 marks)

- Part 2 : Statistics (40 Marks)

Paper 4 : Business Economics (100Marks)

SECOND STAGE - CA INTERMEDIATE

A student after clearing Foundation or Degree (B Com 55% / above or any other degree 60% / above) can register for Intermediate Course

Subjects

Number of Papers – 6

Group I

Paper 1 : Advanced Accounting (100 Marks)

Paper 2 : Corporate & Other Laws (100 Marks)

Paper 3 : Taxation (100 Marks)

Section A : Income Tax Law (50 Marks)

Section B : Goods and Services Tax (GST) (50 Marks)

Group II

Paper 4 : Cost & Management Accounting (100 Marks)

Paper 5 : Auditing and Ethics (100 Marks )

Paper 6 A : Financial Management (50 Marks)

Paper 6 B : Strategic Management (50 Marks)

THIRD STAGE - ARTICLESHIP

After clearing both Groups of Intermediate level, students are required to undergo two years of uninterrupted practical training under a practising Chartered Accountant. It will enable the students to apply the theoretical knowledge acquired at the previous levels in practical scenarios.

The last year of practical training can be done as an industrial trainee in an approved industrial undertaking.

FOURTH STAGE - CA FINAL

Successfully complete Advanced ICITSS and Self – Paced Online Modules along with 2 years of Practical Training and appear the Final Examination 6 months after Practical Training is completed.

Number of Papers – 6

Group 1

Paper 1 : Financial Reporting (100 Marks)

Paper 2 : Advanced Financial Management (100 Marks)

Paper 3 : Advanced Auditing, Assurance & Professional Ethics (100 Marks)

Group ll

Paper 4 : Direct Tax Laws & international Taxation (100marks)

Paper 5 : Indirect Tax Laws (100 Marks)

Paper 6 : Integrated Business Solution (100 Marks)

(Multi disciplinary case study with strategic management)